Most companies approaching the $1 million revenue mark begin to experience structural friction that exposes the limits of scattered systems and siloed vendors. Growth becomes less about demand and more about operational readiness, team performance, and coordinated execution. Yet the traditional model, multiple agencies, consultants, recruiters, and tools, often creates more complexity than it solves. This article analyzes an alternative approach built around integration, performance alignment, and cost efficiency. Through four detailed sections, we examine the real costs of scaling, compare execution models, and assess how Mokhtar Group is restructuring the way growth infrastructure is delivered.

Execution is the ability to mesh strategy with reality, align people with goals, and achieve the promised results.

Larry Bossidy, CEO Honeywell

The Real Cost of Scaling and Why Fragmented Growth Models Fail

For companies reaching the $1 million annual revenue threshold, growth is no longer a matter of generating demand; it becomes a matter of infrastructure. Many executive teams respond by hiring specialized vendors, internal managers, and consultants to help them scale. On paper, this seems prudent. In practice, it often leads to spiraling costs, fractured systems, and months of lost momentum.

The problem isn’t incompetence. It’s fragmentation.

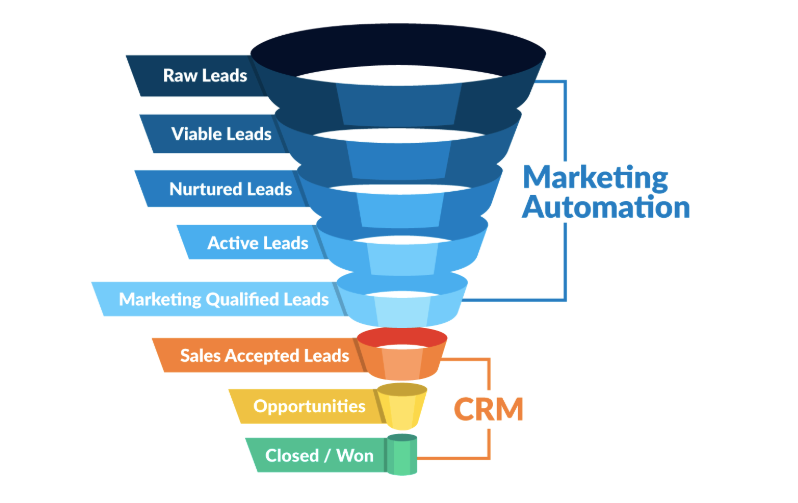

When a company tries to scale using the traditional patchwork model, each layer, CRM setup, recruiting, training, outbound strategy, content, reporting, and automation, is owned by a different vendor or department. These entities don’t share infrastructure, incentives, or timelines. Misalignment is built into the model.

According to HubSpot’s partner network pricing, CRM customization projects typically run between $10,000 and $25,000, and take 2 to 3 months to complete. Recruiting a single SDR or closer, even through mid-tier agencies, costs $7,000 to $15,000 per hire, not including the management time required to onboard and supervise them. Sales enablement training from respected firms like Winning by Design or Sandler can cost $15,000 to $40,000 per cohort, and usually requires multiple follow-up sessions or workshops. None of this includes the cost of actually acquiring leads, running outbound campaigns, or managing reporting infrastructure.

Meanwhile, outbound lead generation providers such as CIENCE, Martal, or Belkins charge between $2,000 and $7,000 per month, usually without guaranteeing performance. Over the course of a year, this means most companies spend well over $75,000 just assembling the minimum viable sales infrastructure, often with only partial integration and limited accountability between vendors.

Let’s put these numbers into a working comparison:

| Function | Typical Vendor | Average Annual Cost | Time to Operational Readiness |

|---|---|---|---|

| CRM Setup & Customization | HubSpot/Salesforce Partners | $10,000–$25,000 | 2–3 months |

| SDR Recruitment & Training | Recruiters + Sales Trainers | $30,000–$50,000 | 2–4 months |

| Outbound Campaign Management | Cold Outreach Agencies | $24,000–$60,000 | Monthly delivery, 6+ weeks setup |

| Forecasting & KPI Reporting | BI Consultants | $8,000–$20,000 | 1–2 months |

| Licensing for Sales Stack (CRM, Automation, etc.) | SaaS Tools | $5,000–$15,000 | Ongoing |

| Total Annual Cost | Varies | $77,000–$170,000+ | 6–12 months to full setup |

This cost structure doesn’t account for failure points, vendor turnover, delayed deliverables, failed hires, or misalignment between sales and marketing. Nor does it reflect internal management time, legal complexity in multiple contracts, or the cognitive load of decision-making across several disconnected tools and relationships.

Beyond the numbers, this model creates structural fragility. If one vendor fails to deliver, say the lead generation agency delivers weak contacts, or the training firm doesn’t prepare new reps properly, the entire growth effort falters. Accountability becomes ambiguous. Was it a lead quality problem? A training issue? A CRM misconfiguration? Fragmented execution means you never know for sure.

The effect on capital is also non-trivial. Investors and financial partners evaluating scale-up readiness look for clear systems, repeatable pipelines, and predictable forecasting. Disconnected vendors make this harder to prove. A startup or mid-market company may be building momentum, but if their performance data is scattered across spreadsheets, third-party systems, and tools with no central control, it raises risk concerns.

Harvard Business School professor Joseph Fuller notes that “when systems aren’t integrated and decision rights are unclear, the likelihood of strategic underperformance increases” (HBS Working Knowledge). Similarly, McKinsey’s 2023 Growth & Transformation report warns that fragmented go-to-market operations often “consume budget faster than they return value,” particularly in companies under $20M in revenue.

In sum, the traditional model may appear logical from a budgeting standpoint, because it lets companies modularize their growth functions. But from an executive performance perspective, it’s inefficient, expensive, slow, and risky.

There’s no real central nervous system.

In the next section, we’ll examine how Mokhtar Group structures its offering to solve exactly this problem, through integration, shared incentives, and operational readiness delivered in weeks, not quarters.

Mokhtar Group’s Integrated Model, Replacing Fragmentation with Aligned Execution

After seeing the numbers, many executives ask: why hasn’t someone just bundled all this together already?

The truth is, most firms specialize in slices of the growth process, CRM consultants handle only setup, sales recruiters stop after hiring, lead generation agencies avoid training, and marketing agencies focus on campaigns without integrating sales systems. This fragmentation keeps vendors busy, but it leaves the company with a fragile structure.

Mokhtar Group’s model was built from the opposite angle. Instead of delivering siloed functions, it provides a complete business development system, the tech, the people, the training, the data, and the execution, in one fully integrated solution. And crucially, it doesn’t stop at delivery; it aligns with outcomes. Clients pay a fixed monthly infrastructure fee ($3,950/month under the Growth plan) plus a performance-based sales commission ranging between 3% and 20%, depending on the scope and industry.

This isn’t semantics. This model flips the usual equation. The base fee simply covers execution. Mokhtar Group only profits when the client grows.

The Growth Plan, which is their flagship solution for companies doing $1M to $20M in annual revenue, includes everything that typically takes months to assemble and thousands in fees to coordinate. The plan delivers over 2,000 qualified C-level and director-level B2B leads every month, customized CRM setup and automation, full onboarding and training of your sales team, objection-handling systems, forecasting dashboards, AI sales assistants, and Centralizen, Mokhtar Group’s enterprise-grade platform for collaboration, CRM, content management, and learning systems. Clients get 10 employee seats included, plus 10 custom AI bots, all without paying separately for licenses, consultants, or third-party contractors.

Most importantly, this structure isn’t theoretical. Companies are operational within weeks, not months. CRM configuration takes days, not quarters. SDR hiring and training begin immediately. And campaign launch cycles are coordinated centrally, so there are no handoffs, gaps, or blame games between parties.

Let’s compare what’s included in Mokhtar Group’s Growth Plan versus the typical cost of sourcing and coordinating these services independently:

| Function | Included in Mokhtar Group Growth Plan | Cost with Traditional Vendors | Time to Deliver via MG |

|---|---|---|---|

| CRM Setup & Automation | Yes | $10,000–$25,000 | 2–4 weeks |

| Lead Generation (2K/mo B2B leads) | Yes | $24,000–$48,000/year | Monthly |

| Sales Recruiting + Onboarding | Yes | $30,000–$50,000/year | < 60 days |

| Sales Playbook & Objection Matrices | Yes | $5,000–$15,000 | Built-In |

| Performance Forecasting & Reporting | Yes | $8,000–$20,000 | Built-In |

| Account Management & Upselling | Yes | $12,000–$25,000/year | Ongoing |

| Custom AI Sales Bots (10 included) | Yes | $5,000–$10,000 | Built-In |

| Centralizen Suite (Unlimited Users) | Yes | $6,000–$15,000/year | Immediate |

| eLearning & Onboarding Tools | Yes (20% discount) | $20,000+ | Ongoing |

| Total Value | Yes | $120,000–$230,000/year | Delivered in Weeks |

For $47,400 per year (Growth plan), you are effectively replacing a $150K to $200K cost center, and doing it with a company that’s built this model specifically for growth-stage businesses. There are no long contract delays. No inflated SaaS licensing negotiations. No separate vendor scopes. It’s a single point of accountability.

The other often-overlooked benefit is liability reduction.

Every additional vendor contract introduces legal complexity. Every misalignment introduces operational lag. Every offshore agency that isn’t vetted and managed through a trusted compliance system introduces risk, from data privacy violations to FCPA exposure. Mokhtar Group simplifies all of this. Because the system is vertically integrated and project-managed under a single structure, the compliance burden on the client is reduced. There’s no need to manage vendor NDAs, audit disparate pipelines, or investigate missing handoffs between functions.

And because Centralizen includes its own permission systems, multilingual interfaces, and internal communication protocols, cross-border collaboration is already structured with business continuity in mind.

This matters to CFOs and COOs because it changes the equation from managing vendor chaos to executing a centralized strategy.

A Real-World Look at Value vs. Traditional Vendors and Growth Agencies

When considering growth solutions, most executives fall into one of two camps. The first builds in-house or cobbles together multiple vendors. The second works with agencies that claim to deliver full-funnel growth, but in reality, most agencies still rely on a patchwork of subcontractors, third-party tools, and generalized templates.

To evaluate Mokhtar Group’s position in this landscape, we’ll examine how its Growth Plan compares against both traditional vendor combinations and major players offering similar services.

This comparison focuses on companies generating $1M to $20M in annual revenue, those with enough resources to invest, but not enough to absorb failure across multiple disconnected vendors or internal experiments.

First, let’s look at what it takes to replicate Mokhtar Group’s Growth Plan using conventional options.

| Function | Mokhtar Group (Growth Plan) | Typical Combined Vendors | Notes |

|---|---|---|---|

| Monthly Cost | $3,950 + performance commission | $8,000–$20,000+ | Mokhtar includes all execution under one roof |

| CRM Setup + Automation | Included | $10K–$25K (HubSpot, Salesforce partners) | External consultants bill hourly and need client-side oversight |

| Lead Generation | 2,000 qualified leads/month | $2,000–$7,000/month | Most vendors offer unqualified or low-intent leads |

| SDR & Closer Recruiting | Included + managed | $5,000–$15,000 per hire | Does not include onboarding or oversight |

| Sales Enablement & Training | Included | $15,000–$40,000 | Delivered by firms like Winning by Design, Sandler, or outsourced trainers |

| Account Management & Forecasting | Included | $10,000–$25,000/year | Often built manually or requires additional platforms |

| AI Sales Automation | 10 bots included | $5,000–$15,000/year | Most growth agencies do not offer custom bots |

| Performance Tracking | Built-in | Requires separate BI tools | PowerBI, Tableau, and HubSpot add-ons often needed |

| Strategic Oversight | Included | Consultant retainers ($3,000+/mo) | Often disconnected from execution layer |

| Total Annual Value | $47,400 + commission | $120K–$250K+ | Not including delays or integration errors |

In practice, most businesses attempting to replicate Mokhtar Group’s system end up dealing with 5 to 10 separate vendors and platforms, leading to high project management overhead, contractual complexity, legal exposure, and scattered accountability.

Let’s now compare Mokhtar Group against several well-known players that offer adjacent services:

| Provider | Annual Cost | Commission-Based? | Offers Recruiting? | Integrated Platform? | Time to Launch | Investor-Ready Support? |

|---|---|---|---|---|---|---|

| Mokhtar Group (Standard Plan) | $23,400 + 3–20% commission | Yes | Yes (screened & trained) | Yes (Centralizen Suite) | ~2–4 weeks | Yes (VC intros if qualified) |

| Winning by Design | $40K–$100K | No | No | No | 2–3 months (training only) | No |

| CIENCE / Martal | $24K–$84K | No | No | No | 4–6 weeks (leads only) | No |

| HubSpot Agency + CRM Consultant | $60K–$150K+ | No | No | Partially | 2–3 months | No |

| RevOps Consultant + Recruiter + CRM Tools | $90K–$180K+ | No | Yes | No | 3–6 months | No |

Even firms with a strong reputation for sales strategy like Winning by Design don’t touch recruitment, automation, or CRM execution. Lead generation platforms deliver leads but don’t prepare sales teams or manage pipelines. CRM agencies offer setup, but little support around human capital or content workflows. And nearly none of them align compensation with client success.

Mokhtar Group’s pricing appears modest on the surface, but when examined in the context of what is actually delivered, it becomes clear that their pricing is not just affordable. It’s structurally different. The base fee covers operational delivery. Profit only happens if growth happens.

The incentive structure is not just strategic. It reduces waste. No misaligned retainer fees. No spending on tools that don’t connect. No delayed rollouts while consultants define workflows. From the client’s perspective, it’s an execution partner who is embedded, but not on payroll.

Strategic Stability: How Mokhtar Group Reduces Risk, Friction, and Barriers to Capital

When growth fails, it’s rarely due to a lack of opportunity. More often, it’s the byproduct of complexity, friction, and poor internal alignment. Companies build toward scale by layering tools, vendors, contractors, consultants, and internal hires, but each new layer creates points of failure: missed handoffs, redundant spending, finger-pointing, or incomplete data.

For founders, CEOs, and boards, this isn’t just frustrating. It becomes dangerous.

Operational fragmentation increases liability. With every new third-party contractor, a company assumes more compliance exposure: NDAs to manage, regional laws to navigate, and internal stakeholders to coordinate. According to a 2023 Deloitte report, over 62% of mid-sized firms surveyed had experienced financial or reputational damage due to failures in third-party vendor oversight. That’s not theoretical, it’s operational.

Mokhtar Group addresses this risk at the structural level.

Because it serves as the unified growth infrastructure provider, not just a vendor, it eliminates inter-vendor coordination problems entirely. CRM automation, outbound campaigns, recruiting, training, forecasting, AI integration, account management: it all sits within one command center. One accountability framework. One reporting system.

The legal implications matter. Fewer contracts. Fewer exposed APIs. Fewer off-platform freelancers or foreign agents operating outside a compliance framework. When tools and people are managed under a single roof with strict client permissions (as Centralizen provides), the legal overhead drops and business continuity improves.

Beyond risk reduction, this unified model also reduces internal friction, a critical factor in scaling. In traditional setups, marketing owns the CRM vendor, sales owns the recruiting firm, operations owns the automation, and no one owns performance. The result is that strategic decisions are bottlenecked or get second-guessed across departments. With Mokhtar Group, the entire system is co-engineered with the leadership team and run on shared KPIs. There’s no debate over attribution. No ambiguity around lead quality, rep readiness, or forecast credibility.

That alignment carries directly into capital access.

Venture capitalists and institutional investors consistently cite “operational clarity” and “pipeline stability” as key requirements for funding consideration. A company may have traction, but if it can’t show predictable processes and an integrated infrastructure, it raises red flags. As Sequoia Capital outlines in its startup guide, scalable models must demonstrate not just customer acquisition, but repeatable systems and readiness for outside capital.

Mokhtar Group makes companies more operationally sound and connects them directly to the capital that enables further scale. For clients generating $1M or more in annual revenue, with provable P&L and a clean infrastructure (especially those using Centralizen fully or partially), Mokhtar Group guarantees introductions to top-tier venture capitalists and private equity groups in both the United States and the GCC. These are not informal referrals, they are strategic introductions shaped by years of institutional relationships and vetted via readiness frameworks.

For companies preparing for Series A or B rounds, or even strategic acquisition, this kind of access is not only valuable, it’s often the difference between momentum and stagnation.

In summary, Mokhtar Group’s real advantage isn’t just financial. It’s systemic.

- It reduces cost by collapsing vendor stacks.

- It reduces risk by simplifying legal and operational oversight.

- It reduces time-to-readiness by delivering execution in weeks, not quarters.

- And it improves access to growth capital by turning scattered systems into one credible, trackable, investor-grade platform.

Mokhtar Group’s credibility isn’t built on theory. It’s led by Karim Mokhtar, recently recognized as one of the top 100 CEOs in the United States business development space by BestStartup.us. Beyond that, Mokhtar has co-founded both Inc 100 and Fortune 500 companies, bringing a uniquely cross-dimensional understanding of what it takes to move from early traction to long-term market dominance. For clients, this isn’t just about services — it’s about aligning with a leadership team that has done it before, at scale.